Abstract

Digital transformation involves fundamental changes in business models, organizational structure, corporate culture, and even the way in which customers interact. Chinese new energy vehicle companies hope to achieve faster response speeds, greater operational efficiency, and better user experiences through digital transformation. Therefore, exploring how to successfully carry out digital transformation and its true impact on enterprise performance is of profound significance. The digital transformation of enterprises requires the embedding and absorption of network relationships to acquire and transform external resources and technologies, which further affects the innovation performance of these enterprises. This article introduces absorptive capacity as a mediating variable and network embeddedness as a moderating variable to construct a theoretical model, attempting to elucidate the mechanism of the impact of digital transformation on enterprise innovation performance. By combining theoretical and empirical analysis, the research hypotheses are tested, and the results show that 1. digital transformation (digital technology, digital products, and digital platforms) has a positive impact on enterprise innovation performance, 2. absorptive capacity plays a significant mediating role in the relationship between digital transformation and enterprise innovation performance, and 3. the embeddedness of network relationships has a significant positive moderating effect on the digital transformation of enterprises and their innovation performance. This article delves into an effective approach involving digital transformation, absorptive capacity, and enterprise innovation performance; analyses the moderating effect of network embeddedness; and concludes that the research findings have implications for the development of related research on digital transformation and enterprise innovation. The timely activities of enterprises to effectively carry out digital transformation, as well as the formulation of relevant policies, have positive significance.

Similar content being viewed by others

Introduction

According to data in the China Digital Transformation White Paper (2021), China’s digital economy indicators are continuing to grow at a rate of 9.7%, making them a core driver of a stable economy. Similarly, according to the data in the China Digital Transformation White Paper (2022) for 2021 and 2022, it is revealed that China’s digital economy totaled $39.2 trillion and $50.2 trillion in these two years, accounting for 38.6% and 41.5% of the total annual gross domestic product (GDP), respectively; it is evident that China’s digital economy possesses a certain scale of development and has been maintaining an upwards momentum. The digital economy has laid a technological foundation for new economic development, and the digital transformation of enterprises has ushered in various opportunities.

At this stage, the digital transformation of enterprises can strengthen the complementarity of resources among enterprises, reduce friction and conflict, improve the efficiency and transparency of communication, improve the efficiency of resource exchange and combination, and positively affect enterprise performance (Yu and Mei 2016). At the same time, there is a consensus on the role of digital transformation in optimizing resource allocation, reducing costs, and improving economic efficiency (Wang et al. 2020), and most scholars recognize that digital transformation can optimize production, supply, marketing and management modes; enhance competitiveness; and help achieve sustainable development (Tiwana et al. 2010).

However, there is a notable divergence among scholars from different regions on how enterprises can carry out good digital transformation. Studies by Western scholars have revealed the impact of digital transformation on firm performance at the individual, organizational, and industrial levels, arguing that the executive level is conducive to different power configurations and the optimization of the top management structure through changes in roles in the digital transformation process (Marabelli and Galliers 2017). Chinese scholars, in contrast, have conducted research from the perspectives of resource optimization, social networks, and intra-organizational personnel, arguing that the empowerment of digital technology also enhances resource complementarity among enterprises, reduces friction and conflict, improves communication efficiency and transparency, increases the efficiency of resource exchange and combination, and positively affects enterprise performance (Pei et al. 2023).

Although some enterprises have carried out work related to digital transformation, they are still unable to effectively integrate digital technology with actual business and fail to achieve the expected results, which indicates that the mechanism of the impact of digital transformation on enterprise performance is insufficient at this stage of research. One study has shown that through social network embeddedness theory from the three perspectives of intelligence, connectivity and analysis, enterprise digital transformation through mutual communication with the outside world regarding enterprise value can be further enhanced (Lenka et al. 2017). Therefore, the results of enterprise digital transformation need to focus on the internal and external ecological network of the enterprise and consider the influence of network embeddedness to provide comprehensive information on the effect of enterprise digital transformation. In reality, the relationships among enterprises not only exist within the normal network but also include absorptive capacity, which is the ability of enterprises to identify external resources and introduce them to achieve the goal, which plays a strong role in the current enterprise’s ability to achieve digital transformation. Sheshadri et al.’s (2022) study concluded that absorptive capacity is the ability of an enterprise to identify, evaluate, digest, apply, and share new knowledge at the global level and to identify and evaluate new knowledge at the global level. New knowledge and knowledge sharing at the global level can contribute to a firm’s ability to innovate. Thus, this study follows the research on network embeddedness theory to investigate how network embeddedness and absorptive capacity affect firm performance in digital transformation.

Theoretical analysis and research hypotheses

Theoretical modeling

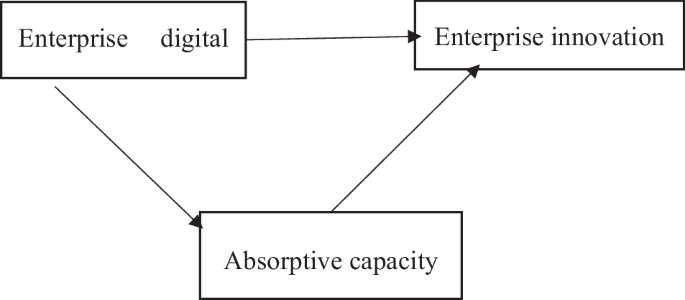

The key for enterprises to achieve organizational optimization, process efficiency and innovation performance through digital transformation is the acquisition and absorption of external technological resources and heterogeneous knowledge. Therefore, this paper discusses the role of absorptive capacity in the impact of digital transformation on enterprise innovation performance. The research framework, involving digital transformation, absorptive capacity, and enterprise innovation performance, is constructed. Since an enterprise is a member of the whole social network and the strength of network relational embeddedness affects the enterprise’s acquisition of explicit and tacit knowledge, the network embeddedness relationship is taken as a moderating variable.

Enterprises use digital technology to improve organizational effectiveness and develop new business models to directly enhance their innovation performance; in the process of digital transformation, the external resources, technologies and expertise acquired by enterprises through digital technology need to be digested, transformed and applied by these enterprises to enhance their innovation performance. When an enterprise acquires external resources, mutual trust and good and efficient communication between the enterprise and its partners are more conducive to the mutual flow of resources within the enterprise, which promotes the integration and utilization of resources and enhances performance. The theoretical research model of this paper is shown in Fig. 1.

In the model, “Enterprise Digital Transformation” serves as an independent variable, covering three dimensions: digital technology, digital transformation, and digital platforms. “Network Embedding” acts as a moderating variable throughout the model, facilitating the flow of resources and information, which supports and enhances the digital transformation of enterprises. “Absorptive Capacity” functions as a mediating variable, further subdivided into knowledge acceptance, knowledge digestion, knowledge transformation, and knowledge application, while “Innovation Performance” is the dependent variable of the model. Theoretical research model uses solid arrows to represent the influence paths between different elements, while dashed boxes distinguish the various thematic sections.

Formulation of research hypotheses

Hypothesis on the relationship between digital transformation and business performance

Digital transformation has attracted a great deal of research in academia, and Chinese and foreign scholars have studied how digital transformation affects enterprise performance through both qualitative and quantitative analyses. For example, Zhou et al. (2020) used panel data from 73 districts in Zhejiang Province from 2015 to 2017 to prove the impact of the regional digitalization level on innovation performance from four perspectives: digital access, digital equipment, digital platform construction and digital application level. Chi et al. (2020) noted that digital transformation can ’positively affect enterprises’ R&D capability through new product development. Furthermore, Savolainen and Knudsen (2022) argued that innovation performance can be measured by the number of patents and the cost of new product development.

With advanced digital technologies such as big data and edge computing, data are an important resource with great potential to be mined and can effectively advance the development of enterprises. The establishment of a data platform for efficient sharing and exchange through digital transformation can further influence the optimization of the enterprise organizational structure, the rational and effective allocation of resources, and the improvement in operational efficiency. In their development, enterprises that rely only on internal resources are far from sufficient, and the need to continuously absorb knowledge, technology, talent, capital, and other aspects, such as the efficiency of the constraints placed on business performance factors, from the outside world affects their development, the advantages and disadvantages of such resources, and their access to these resources. Digital transformation through a digital information platform can help enterprises more conveniently and quickly access the resource information embedded in the network. This situation prompts the enterprise to absorb knowledge and enhance its overall intelligence level, thus improving its overall performance.

Therefore, the view that digital transformation positively affects enterprise performance is unanimously recognized in the academic world. First, digital transformation positively affects enterprise performance through digital technology empowerment for enterprise management capabilities, process efficiency, financial performance, and innovation performance enhancement; second, digital transformation positively affects enterprise performance through the network embedding effect, the building of data platforms to enhance internal organization and individual knowledge, and technology absorption, thereby positively affecting enterprise performance by enhancing individual capabilities; and third, digital transformation positively affects enterprise performance through the use of digital products to cope with market changes to better meet user requirements. Based on the above comprehensive description, this paper proposes the following hypotheses:

H1: Digital transformation has a positive impact on firms’ innovation performance.

H1a: Digital technology has a positive impact on firms’ innovation performance.

H1b: Digital products have a positive impact on firms’ innovation performance.

H1c: Digital platforms have a positive impact on firms’ innovation performance.

Absorptive capacity and innovation performance

Knowledge is the basis of any innovation, and absorption is the acquisition, digestion, transformation and application of knowledge. There is no consensus in the literature on absorptive capacity. This paper adopts Zahra and George (2002) view that knowledge absorption is a process with the following four components: acceptance, digestion, transformation, and development. Enterprises can absorb new knowledge from external sources, redefine products, optimize management processes, develop new products, create new business models, etc.; in this way, enterprises can enhance their competitiveness and achieve long-term sustainable development. Among the four elements of knowledge absorption, acceptance and digestion imply the potential absorptive capacity of the enterprise. Due to the heterogeneity of knowledge, it is impossible for the enterprise to completely copy external knowledge. The enterprise needs to identify the most suitable knowledge according to its characteristics, combined with its accumulated knowledge and experience, that is, a fusion of new knowledge acquired and transformed into skills suitable for its development; transformation and development imply the actual absorptive capacity of the enterprise, and new development skills are realized in the form of new products, new processes, and new business models. These new products, new processes, and new business models create more value for the enterprise. Enterprises with strong absorptive capacity can quickly improve their knowledge, diffuse it in its operation and development, and profit from it. Therefore, the following hypothesis is proposed:

H2: Absorptive capacity has a positive effect on firms’ innovation performance.

Relationship between digital transformation and absorptive capacity

Digital transformation is a process of enterprise change in which an enterprise can guarantee sustainable development to cope with the changing external environment, and is the key to the everlasting success of the enterprise (Wang and Kang 2023). Absorptive capacity plays an important role in the digital transformation process of enterprises.

Digital platforms provide a basis for enterprises to acquire new knowledge and technology, expand their knowledge acquisition channels, increase interenterprise communication, and provide them with the possibility of accepting more external knowledge. A platform ecosystem built with the support of digital technology promotes an enterprise’s access to resources and changes resource ownership thinking to resource orchestration thinking; an enterprise’s ability to acquire and digest knowledge has a greater impact on improving the efficiency and accuracy of accessing external resources through the digital platform than on other actions. The sustainable development of enterprises is financed by the profits made from product sales. An increasing number of users are demanding good product experiences, and how to accurately grasp the market trend and produce the best user experience products is a major problem facing enterprises in their development. Digital information technology assists enterprises in quickly obtaining market and user information and making precise decisions on product direction. Yin Ximing et al. believe that a digital strategy significantly improves the green technology innovation ability of enterprises.

The shifts in thinking of executives and employees play a key role in the digital transformation of enterprises. The knowledge acquisition and digestion ability of corporate executives and employees becomes very important. Digital technology, digital products, and digital platforms in digital transformation are all designed to enhance the knowledge acquisition, digestion, conversion, and application capabilities of enterprises by broadening knowledge acquisition channels, improving the efficiency of knowledge acquisition and digestion, and transforming the thinking of enterprise operations. Therefore, the following hypothesis is proposed:

H3: Digital transformation has a significant positive effect on absorptive capacity.

Mediating role of absorptive capacity

Digital technology enhances the synergistic ability of enterprises among themselves and between themselves and academia, and absorptive capacity has an obvious mediating role in the relationship between the industry-academia-research synergy and innovation performance (Ye and Chen 2022). The dimension of absorptive capacity is currently recognized by academics in terms of Zahrah and Dwiputra (2023) four-factor approach involving acceptance, digestion, conversion, and application. This paper also recognizes this dimension. Startups that are good at integrating internal resources and external networks perform well, as the ability of a company to integrate and reconfigure its resources is a very important capability to ensure its survival. The digital transformation of the enterprise occurs through its absorptive capacity for internal and external resource digestion, absorption and use to achieve the integration of resources and reconstruction, to identify more opportunities, and to improve enterprise performance (Wanner et al. 2019). In the process of enterprise digital transformation, digital technology empowerment and knowledge absorption promote one another, and through continuous learning and absorption, enterprises can realize the integration of internal and external resources, the digital governance of internal and external processes, the optimization of the development path, and the completion of strategic adjustment.

According to H3 of this paper, enterprise digital transformation has a significant positive impact on absorptive capacity; according to the literature, absorptive capacity has a significant positive impact on the innovation performance of enterprises (Zhou 2021). The absorptive capacity of the enterprise fuels the improvement in its resource integration ability and internal and external resource flow between the various departments of the enterprise. Moreover, due to the horizontal structure of the enterprise, the resources are transformed through the absorption of each department, integrated and combined to form the enterprise’s new knowledge and technology, thus enhancing the competitiveness of the enterprise. According to H1, digital transformation has a positive effect on enterprise performance and absorptive capacity; with insufficient absorptive capacity, digital transformation has a direct effect on enterprise innovation performance. Based on the abovementioned studies and related literature, H4 is proposed as follows:

H4: Absorptive capacity mediates the relationship between firms’ digital transformation and firms’ innovation performance.

Moderating role of network relational embeddedness

In the paradigm of organizational networking, the relationship between economic behavior and social structure is becoming stronger. Embeddedness is the process by which social relations influence economic behavior. In reality, relationships among firms exist not only in the form of normal network relationships but also through social factors, the ability to enhance problem solving among firms through trust relationships, and other social relationships. Network embeddedness is the extent to which the relationship between a firm and its related cooperative partners is embedded in the whole network. This paper follows Granovetter’s (1985) approach and divides embeddedness into two categories: relational and structural embeddedness. Network relational embeddedness emphasizes the qualitative role of relationships based on the strength of the embedded relationships for knowledge transfer and access to invisible knowledge affecting firms’ innovation performance, while structural embeddedness emphasizes the structural qualities of firms embedded in the network, which are closely related to the location of the network, and focuses on the configuration of firms’ relational networks.

From the perspective of structural embeddedness, the channels and quality of the enterprise’s access to resources are related to the structural location of the network in which the enterprise is located. According to Florin et al. (2003), the more social capital a firm possesses, the more successful the workplace, the greater the quality of innovation, the faster the organizational growth, and the greater the level of interorganisational learning the enterprise can achieve. Second, the better the network position is, the lower the cost of acquiring external resources, the greater the efficiency, and the greater the ability to convert acquired knowledge and proprietary resources into actual outputs and profits, thus reducing the risk of failure. Third, the firm occupying the middle of the network is more likely to be in a position to acquire external resources, thus reducing the risk of failure. Third, occupying a favorable position in the network is conducive to enterprises broadening information channels and realizing technological innovation; finally, enterprises occupying favorable network positions are more conducive to acquiring and accumulating raw data, obtaining real user needs, and facilitating innovation and other types of enterprise performance.

From the perspective of relational embeddedness, the establishment and maintenance of good relationships between enterprises and their partners is conducive to the establishment of good trust among enterprises and the acquisition of explicit and invisible knowledge; especially for regions where intellectual property rights and trust mechanisms are not sound, enhancing the efficiency of transactions is a very important way in which to obtain resources. First, network embedding is conducive to the establishment of a sense of trust between the top management of enterprises, which establishes a good foundation for the transfer of resources across organizational borders. Second, maintaining good communication relationships among enterprises and maintaining the smooth sharing of technological information are conducive to the reinnovation and development of these enterprises. Third, the main bodies of enterprises, universities, investment institutions, etc., embedded in the network can obtain the information they need, which is beneficial for their organizational structures. Fourth, when enterprises maintain good communication with users and interoperate with one another in terms of information, it can help them identify the real needs of users so that they can adjust their business models in a timely manner to design and produce products that meet the real needs of users and to enhance the performance of enterprises.

Therefore, regardless of the type of network being embedded, it can help enterprises quickly access external resources and help partners and users maintain increased contact with the contact rate and contact surface, which is conducive to identifying more of the real needs and information of users and partners to stimulate the sales and innovation performance of enterprises. Therefore, the following hypothesis is proposed:

H5: There is a significant positive moderating effect of network relational embeddedness on digital transformation and enterprise innovation performance.

Methodology

Variable measurement

The measurement questions used in this paper are all from mature academic scales, with corrections made according to the research direction, and are measured on a five-point Likert scale, with larger scores indicating greater recognition.

Digital transformation measurement: The digital transformation scale was developed based on the mature scales published by Hess et al. (2016), Wang et al. (2020), Vial (2021), etc., and the related question items were mapped to the corresponding variables; at the same time, in conjunction with the actual situation, the mature scale of Chinese scholar Hu (2020) was added.

Measurement of absorptive capacity: Based on Zahrah and Dwiputra (2023) four-dimensional perspective (i.e., knowledge acquisition, digestion, conversion, and application) established from dynamic theory to consider absorptive capacity a dynamic process, Jansen (2005) findings show that absorptive capacity can be divided into potential absorptive capacity and actual absorptive capacity, with the former including acquisition and digestion capacity and the latter including conversion and application dimensions. The survey scale was proposed by Ying et al. (2022), Li and Chenchen (2021) and others.

Innovation performance measurement: It is difficult to have a consistent view of innovation performance measurement in the academic world, and there are only a few scholars who continuously follow up on innovation performance research; considering that it is relatively one sided to examine the innovation performance brought about by digital transformation only in terms of the number of patents, this study utilizes Qian et al. (2010) scale after considering the synthesis of domestic and foreign scholars’ mature scales and practical scenarios.

Measurement of network embeddedness: As an individual in a social network, an enterprise needs to maintain open communication with the outside world, and it cannot survive and develop in a closed environment; as this paper improves on the research on network embeddedness, strong or weak relational embeddedness is shown to have a positive effect on the enterprise’s innovation performance. This paper establishes a measurement table based on the studies of Granovetter (1985), Cheng (2012), Filieri and Alguezaui (2014) and Zhang et al. (2018).

Measurement of control variables: As mentioned previously, regarding the impact of empowering firms’ innovation performance through digital transformation, knowledge and technology play a key role in this process. The acquisition, digestion, conversion and application of knowledge and technology outside the enterprise, the size of the enterprise, the composition of the personnel, the nature of the enterprise and the industry in which the enterprise is located all have an impact. To make the study more rigorous, some control variables are introduced.

Regarding enterprise size, large enterprises typically have more contact with the outside world than do small enterprises due to their large business volume and product variety. Moreover, large enterprises have accumulated richer resources and knowledge and are better at accepting and accommodating heterogeneous knowledge and technology than are small enterprises. However, small and medium-sized enterprises, especially small enterprises, have strong adaptive capacity and quick transformation; they have certain advantages in flexible response. In this paper, we refer to the National Bureau of Statistics’ “Statistics on the division of large, medium, small and micro enterprises”. Combined with the actual situation, enterprise size according to the number of personnel is divided into six intervals—20 employees and below, 21–100 employees, 100–200 employees, 200–300 employees, 300–500 employees, 500 employees or more—and assigned values of 1–6.

With respect to enterprise age, some scholars believe that the longer an enterprise is established and developed, the more abundant its accumulation of various aspects, and the stronger its ability to resist risks; however, some scholars have proposed that the longer an enterprise is, the more inertia it generates in terms of not only thinking but also in terms of resource dependence and solidified thinking, which are not conducive to innovation. Therefore, this paper divides enterprise age into 1–3 years, 3–6 years, 6–10 years, 10–20 years, and more than 20 years and assigns values from 1 to 5.

With respect to the nature of the enterprise, some scholars believe that central and state-owned enterprises in the economy assume a stabilizing role rather than engaging in economic activities, which is not conducive to the drive towards innovation; however, due to the special nature of state-owned enterprises, they can benefit from obtaining the support of the government, colleges and universities and access good innovation resources. Therefore, there is no consistent view of the impact of the nature of enterprises on innovation performance. Therefore, this paper introduces the nature of enterprise ownership as a control variable.

There are also differences in the motivation and demand for innovation depending on the industry in which the enterprise is located. Therefore, in this paper, the industry in which the enterprise is located is used as a dummy variable: 1-manufacturing industry, 2-restaurant industry, 3-retail industry, and 4-real estate.

Data collection

This article obtains data by distributing and collecting questionnaires, then organises and analyses the obtained data to test the hypotheses, and finally presents the conclusions. The questionnaires are targeted at business executives and core managers who have experience with digital technologies, have used digital products and understand digital platforms. Convenience sampling is utilized to distribute and follow up on the returned electronic questionnaires. To ensure the rigor of the study, top managers who play a leading role in digital transformation, middle managers who have the resources to drive the execution of digital transformation, and junior managers who directly execute and optimize digital transformation are selected as the research targets. The targeted research is conducted with 200 enterprises, 186 valid questionnaires are collected, and the proportion of middle, senior, and core managers that completed valid questionnaires is as high as 85.48%. These managers come from domestic mainstream original equipment manufacturers (OEMs; vehicle manufacturing) and mainstream tier-1 suppliers, providing regional coverage of Beijing, Shanghai, the Yangtze River Delta, the Pearl River Delta and other regions, which ensures the representativeness and extensiveness of the questionnaire.

Empirical results and analysis

Sample description

The manufacturing industry accounts for the largest number of firms in the survey data, occupying 53.1%, followed by the Internet and software industry, at 11.3%. The proportions of other industries, such as catering, retail, real estate and finance industries, are relatively small, ranging from 1.6% to 5.4%. Nearly half of the enterprises (46.8%) have been established for more than 20 years, while only 9.7% have been established for between 1 and 3 years. In terms of the nature of ownership, private enterprises dominate the sample, accounting for 51.6%, while state-owned enterprises and wholly foreign-owned enterprises occupy 18.8% and 19.9%, respectively. In terms of enterprise size, most enterprises (63.3%) have more than 500 employees. In terms of the distribution of positions participating in the questionnaire survey, top managers account for 33.3%; middle and junior managers account for 28.5% and 23.7%, respectively; and ordinary employees account for 14.5%. Among the survey participants, those with postgraduate degrees account for 49%, while those with bachelor’s degrees account for 43%. In terms of the distribution of their departments, technology/R&D account for the largest number of people, at 40.2%, followed by the company’s management and marketing departments, accounting for 17.8% and 17.2%, respectively.

Reliability check

In this study, the internal consistency of the survey instrument is assessed by Cronbach’s alpha coefficient for the variables digital technology, digital products, network embeddedness, knowledge acquisition, knowledge digestion, knowledge transformation, knowledge application and innovation performance, which correspond to Cronbach’s alpha coefficients of 0.910, 0.807, 0.859, 0.872, 0.907, 0.904, 0.945 and 0.948, respectively. These results show that the internal consistency of the variables is generally high, especially in the knowledge application and innovation performance dimensions, where the Cronbach’s alpha coefficients exceed 0.940. These results show that the constructs are highly reliable Tables 1–3.

Validity analysis

The table shows that the commonality values corresponding to all the research items are greater than 0.4, indicating that research item information can be effectively extracted. In addition, the Kaiser–Meyer–Olkin (KMO) value is 0.958, which is greater than 0.6, indicating that the information extraction approach is effective. In addition, the variance interpretation rates of the three factors are 29.809%, 21.634%, and 20.532%. The cumulative variance explained after rotation is 71.976%, which is greater than 50%, meaning that the amount of information in each research item is effectively extracted.

Correlation analysis

Correlation analysis is performed using SPSS 23.0 to explore the relationships among the variables, and the results are shown in Table 4.

This table shows the correlation coefficients between firms’ digital transformation and absorptive capacity, network embeddedness and innovation performance—0.821**, 0.818**, and 0.741**, respectively—which shows a significant positive correlation. The correlation coefficients between absorptive capacity and network embeddedness and innovation performance are 0.882** and 0.863**, respectively, indicating a strong positive correlation. The correlation coefficient between network embeddedness and innovation performance is 0.762**, indicating a significant positive correlation.

Multiple linear regression analysis (MLRA)

In this paper, the theoretical hypotheses are tested using SPSS 23.0. MLRAs are conducted with digital transformation as the independent variable, innovation performance as the dependent variable, network relational embeddedness as the moderator variable, absorptive capacity as the mediator variable, and industry where the firm is located Table 5.

Based on the results of the stratified regression analyses provided, the results of the hypothesis testing are as follows:

H1: Digital transformation has a positive impact on corporate innovation performance.

In Model 2, the coefficient of the digital transformation of enterprises is 0.831, and the significance level reaches 0.01. Therefore, this finding supports H1, which states that digital transformation has a positive impact on enterprise innovation performance.

H1a: Digital technology has a positive effect on corporate innovation performance.

In Model 3, the coefficient of digital technology is 0.732, and the significance level reaches 0.01. This finding supports the conclusion of H1a that digital technology has a positive impact on firms’ innovation performance.

H1b: Digital products have a positive effect on corporate innovation performance.

In Model 4, the coefficient of digital products is 0.653, and the significance level reaches 0.01. This finding supports the conclusion of H1b that digital products have a positive impact on firms’ innovation performance.

H1c: Digital platforms have a positive effect on firms’ innovation performance.

In Model 5, the coefficient of the digital platform is 0.688, and the significance level reaches 0.01. This finding supports the conclusion of H1c that digital platforms have a positive impact on firms’ innovation performance. In addition, from the values of R², adjusted R², and ΔR², it can be seen that the explanatory variables included in each model contribute significantly to the explanatory power of the dependent variable (innovation performance). The presented tabular results support the validation of all hypotheses.

The significant positive impact of digital transformation on firms’ innovation performance highlights the need for firms today to adapt to the digital age. As technology advances, consumer behavior and needs are changing rapidly. Firms need to keep up with these changes to remain competitive and exploit new opportunities. While all three factors—technology, products and platforms—fall under the umbrella of digital transformation, the impact of each factor on a business’s innovation performance highlights its importance. This situation acts can act as a reminder for companies not only to have an overall strategy for digitalization but also to pay attention to the segments and develop a clear strategy for each segment. Although the coefficients on industry profile and time of establishment are not significant in most models, this does not mean that they do not have an impact on innovation performance. A possible explanation for this is that the impact of these variables is weaker or more complex than is that of digital transformation. These findings provide practical guidance for companies. To improve innovation performance, firms should consider digital transformation and segment their strategies into areas such as technology, products and platforms. In addition, depending on the nature of their ownership and size, firms also need to consider how best to undertake these transformations.

Model 2 in Table 6 demonstrates the effect of overall absorptive capacity on firms’ innovation performance. The coefficient of absorptive capacity is 1.012 and significant at the 0.01 level, meaning that absorptive capacity has a significant positive effect on firms’ innovation performance. Compared to Model 1, the value of R² increases from 0.055 to 0.750, and the adjusted R² value increases from 0.034 to 0.743, which indicates that overall absorptive capacity explains most of the variation in firms’ innovative performance.

The results of the regression analysis are analyzed to test whether the variables related to absorptive capacity have a significant positive effect on firms’ innovation performance. The analysis of each absorptive-capacity-related variable is presented below.

Knowledge acquisition: In Model 2, the coefficient of knowledge acquisition is −0.061, and the t value is −1.545, which indicates that knowledge acquisition does not have a significant impact on firms’ innovation performance. The reason for this is that enterprises have deficiencies in knowledge identification and are unable to identify whether the acquired knowledge is suitable for enterprise innovation.

Knowledge digestion: In Model 3, the coefficient of knowledge digestion is 0.795 and is significant at the p < 0.01 level, which indicates that knowledge digestion has a significant positive effect on enterprise innovation performance.

Knowledge conversion: In Model 4, the coefficient of knowledge conversion is 0.910, and the t value is 22.097, which is again significant at the p < 0.01 level. This finding indicates that knowledge conversion has an extremely significant positive impact on firms’ innovation performance.

Knowledge application: In Model 5, the coefficient of knowledge application is 0.897, with a t value of 22.655, which indicates that it is significant at the p < 0.01 level. This finding means that knowledge application has a highly significant positive impact on firms’ innovation performance.

The model including overall absorptive capacity indicates a significant positive effect of absorptive capacity on firms’ innovation performance, further validating H2. Moreover, by examining the stages of knowledge absorption (acquisition, digestion, conversion, and application) separately, it can be clearly seen that except for the acquisition stage, all other stages have a positive effect on innovation performance. This finding further confirms that absorptive capacity is a key factor in firms’ innovation performance and provides useful insights into how firms can promote innovation by improving employees’ absorptive capacity. In particular, firms should focus on the ability to transform acquired knowledge into practical applications to achieve their innovation goals (Table 7).

In Model 2, the coefficient of digital transformation reaches 0.959, and its t value is as high as 15.118, which implies that there is a significant positive correlation between digital transformation and absorptive capacity at the 0.01 level of significance, which further verifies H3.

Analysis of the mediating effect of absorptive capacity on the relationship between firms’ digital transformation and innovation performance

The Table 8 is used to test the mediating effect of absorptive capacity on the relationship between digital transformation and enterprise innovation performance. The Table 8 is analyzed in detail below.

Total effect (c path): This indicates the relationship between firms’ digital transformation and innovation performance when the mediating variable (absorptive capacity) is not considered. Its effect is 0.831 and is significant at the 0.01 level. This finding means that firms’ digital transformation has a significant positive effect on innovation performance.

Path a: This is the effect of firms’ digital transformation on absorptive capacity. Its effect is 0.785 and is significant at the 0.01 level, which means that there is a positive relationship between firms’ digital transformation and absorptive capacity.

Path b: This is the effect of absorptive capacity on innovation performance. Its effect is 0.918 and significant at the 0.01 level, indicating a positive relationship between absorptive capacity and innovation performance.

a*b (mediating effect value): This represents the mediating effect of absorptive capacity on the relationship between firms’ digital transformation and innovation performance. The value is 0.720 and is significant at the 0.01 level. The z value is 10.539, indicating that the mediating effect is significant.

The bootstrap confidence interval ranges from 0.522 to 0.793, and since the interval does not contain zero, it further proves that the mediating effect is significant.

In summary, absorptive capacity has a significant mediating effect on the relationship between enterprise digital transformation and innovation performance, which further verifies H4. That is, enterprise digital transformation can improve the absorptive capacity of enterprises, while higher absorptive capacity further promotes enterprise innovation performance. These results show that absorptive capacity fully mediates the relationship between enterprise digital transformation and innovation performance. In other words, enterprise digital transformation improves innovation performance through greater absorptive capacity. Firms’ digital transformation first enhances their absorptive capacity, and then, this enhanced absorptive capacity further drives their innovation performance. This situation provides firms with a strategic direction to enhance their absorptive capacity by strengthening their digital transformation to improve their innovation performance, as shown in Fig. 2.

Regression analysis of the role of network relational embeddedness in moderating digital transformation and firm performance

In Model 1 of Table 9, digital transformation has a significant positive impact on innovation performance. When network relational embeddedness is introduced into Model 2 as another explanatory variable, the direct effect of digital transformation on innovation performance is attenuated, while network relational embeddedness itself has a significant positive effect. In Model 3, an interaction term, the product of digital transformation and network relational embeddedness, is further introduced to test whether network relational embeddedness moderates the effect of digital transformation on innovation performance. The results show that this interaction term is not significant, implying that network relational embedding does not significantly moderate the impact of digital transformation on innovation performance.

In terms of the statistical indicators of the model, the explanatory power of the model (e.g., R^2 and adjusted R^2) increase with the addition of new variables, but the addition of the interaction term does not significantly improve the explanatory power of the model. These results provide firms with insights into how digital transformation and network relational embeddedness independently and jointly affect innovation performance.

Firms undoubtedly need to focus on digital transformation in their pursuit of higher levels of innovation performance. The significant positive impact of digital transformation for organizations means that actively adopting new technologies, optimizing digital processes and training employees in digital skills are all becoming critical in the modern business environment. In addition, network relational embeddedness has positive effects on innovation performance. This finding highlights the importance of enterprises building and maintaining good relationships with suppliers, partners, customers and other stakeholders in the industry or market, as doing so helps facilitate the exchange of information, the sharing of resources and opportunities for collaboration. However, although both factors have a positive impact on innovation performance, they do not reinforce one another. In other words, network relational embeddedness does not enhance or diminish the impact of digital transformation on innovation performance; rather, these factors affect performance independently of one another. Therefore, H5 does not hold, and thus, firms should not expect to gain excess innovation performance by combining these two factors when formulating their strategies but, rather, should optimize and enhance them separately. In addition, given the rapid evolution of markets and technologies, firms should also continuously monitor the relationship between these two factors and innovation performance to ensure that strategic decisions are based on the latest data and trends.

Research innovations and shortcomings

The innovations of this paper are as follows. 1. This work is different from most studies on the direct impact of digital transformation on corporate organizations, strategies, or business innovation models. This paper introduces the absorptive capacity variable; discusses the mediating effect of absorptive capacity on the relationship between digital transformation and enterprise innovation performance; proposes a research framework for digital transformation, absorptive capacity, and enterprise innovation performance; and empirically verifies the relevant hypotheses and conclusions. 2. Based on social network theory, this paper introduces a moderating variable—network relational embeddedness—and discusses whether enterprises embedded in the external environment can better access heterogeneous resources and whether such access is more favorable to enterprise innovation performance. This study further explains the influence mechanism of digital transformation on enterprise innovation performance. 3. The questionnaire in this paper is focused on enterprises in the supply chain system of new car-making forces, covering finance, network technology, parts, vehicle R&D and manufacturing, semiconductors, etc. In particular, the multinational enterprises in this supply chain have rich experience in and have benefitted from digital transformation, and thus, they have a deeper understanding of digital transformation and its impact. Therefore, the data obtained in this research can more accurately reflect the issues addressed in this paper.

The shortcomings of this paper are as follows. 1. Due to the influence of resources, the data volume of the questionnaire is limited and, thus, cannot cover domestic foreign enterprises well; therefore, further data mining research is needed for segmented industries. 2. There are still many factors that affect the digital transformation and innovation performance of enterprises in reality, and the assumptions and models used in this paper deviate from the actual situation, which has a certain effect on the conclusions of the study and the related policy recommendations.

Generous policies and a good management environment have a certain impact on enterprise digital transformation; however, the research in this area is still insufficient, the culture and education level of different regions are different, and the research on the impact of enterprise digital transformation and enterprise innovation performance is also insufficient. Based on the research in this paper, we can introduce government policies and regional factors to further study the relationship between enterprise digital transformation and enterprise innovation performance in the future.

Data availability

The datasets generated and/or analyzed during the current study are available at the following link: https://dataverse.harvard.edu/dataset.xhtml?persistentId=doi:10.7910/DVN/HTPN6Q.

References

Cheng C (2012) Research on the Relationship between Knowledge Inflow, Corporate Creativity, and Innovation Performance Research and Development Manag 24(5):7

China Academy of Information and Communications Technology. White Paper on China’s Digital Transformation (2021) [R/OL]. https://www.cesi.cn/images/editor/20211104/20211104152310850.pdf

China Academy of Information and Communications Technology. White Paper on China’s Digital Transformation (2022) [R/OL]. http://www.caict.ac.cn/kxyj/qwfb/bps/202207/P020220729609949023295.pdf

Chi M-M, Ye D-L, Wang J-J (2020) How to improve the performance of new product development in Chinese small and medium-sized manufacturing enterprises based on the perspective of digital empowerment. Nankai Manag Rev 23(3):63–75

Zhang C, Guo T, Liu H (2018) The impact of network embedding on business model innovation in technology startups Scientific research 36(1):9

Filieri R, Alguezaui S (2014) Structural social capital and innovation. is knowledge transfer the missing link?. J Knowledge Manage

Florin J, Lubatkin M, Schulze W (2003) A Social Capital Model of High-Growth Ventures. Acad Manag J 46(3):374–384

Granovetter M (1985) Economic Action and Social Structure: The problem of Embeddedness. Am J Aocol 91(3):481–510

Hu Q (2020) The mechanism and performance of enterprise digital transformation. Zhejiang Academic J (2)10

Hess T, Matt C, Benlian A et al. (2016) Options for formulating a digital transformation strategy. MIS Q Exec 15(2):123–139

Jansen JJ, Van Den Bosch FA, Volberda HW (2005) Managing potential and realized absorptive capacity: how do organizational antecedents matter? Acad Manag J 48(6):999–1015

Lenka S, Parida V, Wincent J (2017) Digitalization Capabilities as Enablers of Value Co-Creation in Servitizing Firms. Psychol. Mark. 34(1):92–100

Li Z, Chenchen (2021) The impact and mechanism of network embedding on green innovation in enterprises: the mediating role of absorptive capacity. Technological Progress and Countermeasures 38(5):8

Marabelli M, Galliers RD (2017) A reflection on information systems strategising: the role of power and everyday practices. Inf Syst J 27(3):347–366

Pei X, Liu Y, Wang J (2023) Digital transformation of enterprises: Driving factors, economic effects and strategy selection. Reform 5:124–137

Qian X, Yang Y, Xu W (2010) Firm network location, absorptive capacity, and innovation performance-an interaction effect model. Manag World 5:118–129

Sheshadri, Chaudhuri R, Vrontis D (2022) Does remote work flexibility enhance organization performance? Moderating role of organization policy and top management support. J Bus Res 139:1501–1512

Savolainen J, Knudsen MS (2022) Contrasting digital twin vision of manufacturing with the industrial reality. Int J Computer Integrated Manuf 35(2):165–182

Tiwana A, Konsynski B, Bush A (2010) Platform evolution of platform architecture, governance and environmental dynamics. Inf Syst Res 21(4):675–687. 1000,1004,1007

Vial G (2021) Understanding digital transformation: A review and a research agenda. Managing digital transformation 13–66

Wang B, Kang Q (2023) Digital transformation and corporate sustainable development performance. Econ Manag 45(6):161–176

Wang H, Feng J, Zhang et al. (2020) The effect of digital transformation strategy on performance. Int J Confl Manag 31(3):441–462

Wang K, Huang H, Xu X (2020) Digital Twin-driven smart manufacturing: Connotation, reference model, applications and research issues. Robotics and computer-integrated manufacturing 61:101837

Wanner J, Bauer C, Janiesch C (2019) Two-sided digital markets: Disruptive chance meets chicken or egg causality dilemma. In 2019 IEEE 21st Conference on Business Informatics (CBI), vol. 1, IEEE, pp. 335–344

Ye C-S, Chen C-M (2022) Industry-academia-research collaboration, absorptive capacity and corporate innovation performance. Res Sci Technol Manag 42(3):184–194

Yu Y, Mei Q (2016) The impact of relational embeddedness of industrial clusters under the mediating role of portfolio legitimacy on the performance of start-ups. J Manag 13(5):697–706

Ying P, Jiren L, Jialiang C (2022) The Impact of Network Embedding on Innovation Performance of Enterprises and the Mediating Effect of Absorption Capacity Science and Management 42(4):7

Zahrah F, Dwiputra R (2023) Digital citizens: Efforts to accelerate digital transformation. Jurnal Studi Kebijakan Publik 2(1):1–11

Zahra SA, George G (2002) Absorptive capacity: A review, reconceptualization, and extension. Acad of manage rev 27(2):185–203

Zhou Q, Wang Y, Yang W (2020) An empirical study on the impact of digitalisation level on innovation performance-Based on panel data of 73 counties (districts and cities) in Zhejiang Province. Res Manag 7:120–129

Zhou R (2021) The way to improve the innovation performance of enterprises under the perspective of absorptive capacity evolution characteristics - Based on the longitudinal case of Changjiang Runfa. Account Newsl 22:161–166

Acknowledgements

We express our heartfelt thanks to everyone involved in the research for this paper. Special thanks to Professor Zhengbing Wang for providing the research direction and empirical guidance. We appreciate Qiwei Shi’s meticulous revision of the language and text, as well as Siqintana Bao’s strategic suggestions for the manuscript. We are also profoundly grateful for the valuable comments from the reviewers, which significantly improved the quality of our paper. Additionally, we would like to thank the editorial team of this journal for their professional guidance and support throughout the submission process. Furthermore, we thank all data and information providers whose support made our research possible.

Author information

Authors and Affiliations

Contributions

Wei Liu: Drafted the initial manuscript and collected data. Zhengbing Wang: Provided research direction and empirical guidance. Qiwei Shi: Responsible for revising the language and text. Siqintana Bao: Offered strategic suggestions for manuscript revisions, addressing reviewers’ concerns regarding the lack of clear problem awareness.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethics

This research received approval from the Ethics Review Committee of Mongolia University of Finance and Economics (hereinafter referred to as “the Committee”), with the approval number [6/128]. During the research design, data collection, and analysis processes, this study strictly adhered to guidelines and regulations related to research involving human participants, including but not limited to the Declaration of Helsinki and its subsequent amendments, to ensure the full protection of all participants rights.

Informed consent

Before officially commencing the survey research, we issued a comprehensive research overview to each participant to ensure they fully understood the purpose, procedures, potential risks, and benefits of the study. This document detailed the nature of the research, participants’ rights, data usage, and confidentiality measures. Additionally, participants were explicitly informed that they could withdraw from the study at any time without needing to provide a reason. All information was presented in clear and simple language to ensure complete understanding by all participants. Before obtaining their consent, the research team allowed ample time for participants to ask questions and made certain they had a thorough understanding of the research. Furthermore, all data collection and processing in our study strictly adhered to ethical standards and privacy protection principles to ensure the security and confidentiality of participant information. Through these measures, we ensured the ethical integrity of the research and the protection of participants’ rights. After confirming participants’ understanding and consent, we invited employees and executives from upstream and downstream enterprises in the Chinese new energy vehicle industry to participate in the study. The questionnaire survey was then conducted on September 13, 2023, following these confirmations.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Liu, W., Wang, Z., Shi, Q. et al. Impact of the digital transformation of Chinese new energy vehicle enterprises on innovation performance. Humanit Soc Sci Commun 11, 592 (2024). https://doi.org/10.1057/s41599-024-03109-y

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03109-y