Abstract

In response to stricter regulations on ship air emissions, many shipowners have installed exhaust gas cleaning systems, known as scrubbers, allowing for use of cheap residual heavy fuel oil. Scrubbers produce large volumes of acidic and polluted water that is discharged to the sea. Due to environmental concerns, the use of scrubbers is being discussed within the International Maritime Organization. Real-world simulations of global scrubber-vessel activity, applying actual fuel costs and expenses related to scrubber operations, show that 51% of the global scrubber-fitted fleet reached economic break even by the end of 2022, with a surplus of €4.7 billion in 2019 euros. Within five years after installation, more than 95% of the ships with the most common scrubber systems reach break even. However, the marine ecotoxicity damage cost, from scrubber water discharge in the Baltic Sea Area 2014–2022, amounts to >€680 million in 2019 euros, showing that private economic interests come at the expense of marine environmental damage.

Similar content being viewed by others

Main

Since the mid 1900s, the marine bunker fuel market has been dominated by residual fuels, that is, heavy fuel oils (HFOs), due to their low price and high energy content1. HFO is a residual, sulfur-containing product, and during combustion, the sulfur content of the fuel will be proportional to the emissions of sulfur oxides (SOx) and particulate matter (PM) to the atmosphere. Therefore, as of January 2020, the International Maritime Organization (IMO) implemented stricter global regulations regarding the sulfur content of marine fuels, from a maximum of 3.5% to 0.5%, with the goal to reduce the negative impacts of ship-derived SOx and PM on air quality2. Even stricter regulations apply for ships operating in designated sulfur emission control areas (SECAs), where a maximum sulfur content of 0.1% is allowed. To meet sulfur regulations, most ships have switched to the more expensive low-sulfur fuels such as distillate fuels, for example, Marine Gas Oil (MGO), or hybrid fuels, for example, very low-sulfur fuel oils (VLSFOs). Another option is to install exhaust gas cleaning systems (EGCSs), also known as scrubbers, and continue to use the less-expensive HFO with high sulfur content while still being compliant with the IMO regulations. For more than a decade, several studies have shown that more stringent regulations, previously in SECAs and now also globally, have led to a reduction of SOx emissions3,4,5,6, that scrubbers efficiently can reduce the sulfur content in the exhaust to the required compliance levels7,8 and that scrubbers are economically feasible, being a lucrative alternative to fuel switch9,10,11,12. In parallel, concerns have been raised regarding the impact on the marine environment from scrubber water discharge, for example, adverse effects on marine organisms, including reduced growth and increased mortality potential, eutrophication effects on phytoplankton13,14,15,16,17 and acidification effects on local and regional levels5,18,19. Other concerns related to scrubbers include the difficulty in compliance monitoring20,21, the PM air emissions that are not reduced in the same way as a switch to low-sulfur fuels22 and the enabling of continued use of HFO, impeding important development of alternative fuels and other low-carbon options23. Globally, scrubbers have been installed on more than 5,000 ships (https://afi.dnv.com/statistics/) and HFO amounts to approximately 25% of the total marine bunker fuel demand and is forecasted to continue to do so in the near future24. The market share of fossil fuels, and implicitly scrubbers, may see changes in the medium term with the new ambitions set out by IMO to reduce the greenhouse gas emissions from international shipping to (close to) net zero by 205025. Also, the ‘Fit for 55’ strategy, within the European Green Deal, commits to include shipping in the EU Emission Trading System from 2024 and to implement the FuelEU Maritime initiative to mandate transition to low-carbon fuels26.

In the most common scrubber set-up, the open loop, the exhaust gas is led through a fine spray of seawater inside the scrubber. The SOx in the exhaust gas readily dissolves and reacts with the alkaline water forming sulfuric acid. The process implies an hourly production and discharge of hundreds of cubic metres of acidic (pH ≈ 3–4) and polluted (containing, for example, metals, polycyclic aromatic hydrocarbons (PAHs)) scrubber water, which can also have elevated nitrate concentrations due to scavenging of combustion products, that is, nitrogen oxides (NOx)27,28,29. The process is similar for closed-loop systems (<2% of market share), but the water is recirculated and SOx uptake is ensured by the addition of a strong base (for example, NaOH), resulting in smaller volumes being discharged (on average, 0.45 m3 MWh−1) (refs. 29,30). Hybrid systems are scrubbers that can operate in both open- and closed-loop mode. An average scrubber water discharge flow rate of approximately 90 m3 MWh−1 has been reported for open-loop systems, although the highest reported volumes are 140 m3 MWh−1 (refs. 30,31). On a global scale, based on pre-pandemic ship traffic patterns and scrubber installations at the end of 2020, the estimated total discharge volume from open-loop scrubbers is approximately 10 billion m3 per year (ref. 32). The emissions of metals and PAHs from ships running on HFO, with or without a scrubber, are substantially higher than ships using MGO as fuel33. In addition, a recent study showed ships equipped with scrubbers to account for up to 8.5% of the total input of certain PAHs to the Baltic Sea34 and that the discharge of scrubber water substantially increases the environmental risk associated with the release of metals and PAHs in port environments35.

The necessity of guidelines for environmental risk and impact assessment of scrubber discharge water was acknowledged already in 1998 at the 41st meeting of the Marine Environment Protection Committee (MEPC), a senior technical body of marine pollution issues within the IMO. Since then, many member states have commissioned research and literature reviews of the potential impact of scrubbers on the marine environment. During the 78th MEPC meeting (2022), new guidelines on how to assess risk and impact from scrubber water discharge were approved36. The guidelines provide recommendations that member states can use as support when considering stricter discharge regulations. The impact assessment, in section 7.4 of the guidelines, stipulates that the adoption of restrictions or a ban on discharge water from scrubbers should be considered in areas where any of four indicative criteria are fulfilled. The first criterion (paragraph 7.4.1 in the guidelines36) reads ‘environmental objectives in the areas are not met, for example good chemical status, good ecological status or good environmental status are not achieved under applicable legislation’. The three additional criteria are defined with respect to general deterioration of the environment and increased environmental risk, conflicts with conventions and regulations for marine environmental protection and the cost of management of dredged materials in ports36.

In Europe, marine environmental objectives, mentioned in indicative criteria 7.4.1, are defined by the Marine Strategy Framework Directive (MSFD), which aims to achieve Good Environmental Status in all of the European marine waters37. The first assessment was reported by EU member states in 2018 and when all indicators, reported for each MSFD descriptor (11 in total), are aggregated utilizing the one out all out principle, all but six sea basins fail to achieve Good Environmental Status (Fig. 1 and Supplementary Information A). As global maritime traffic is forecasted to increase somewhere between 240 and 1,200% by 2050 as compared to 2014 levels38, the pressure on the marine environment is likely to increase. At the same time, most of the marine ecosystems are facing increased cumulative impacts where shipping is identified as one of the main stressors39.

Aggregated environmental status, considering all descriptors and included indicators, of European sea basins reported to the European Environment Agency Marine Water Information System for Europe database. The result is based on EU member states’ 2018 reporting under the MSFD (2008/56/EC) applying the one out all out principle. More details in Supplementary Information A. Map data from EEA WISE-Marine.

Restrictions or bans on open-loop scrubber water discharge are already adopted in individual ports, inland waters or in territorial waters (for example, Port of Antwerp, Germany inland water, Singapore40) and during the 79th MEPC meeting (2022), the use of scrubbers as an appropriate means of compliance was questioned41,42. Whereas support for restricting the use of scrubbers exists, there are concerns regarding the (economic) ‘uncertainty for the industry, which has in good faith invested in EGCS technology in accordance with the provisions of MARPOL Annex VI’42. The wide-scale use of scrubbers also imply costs related to the degradation of the marine environment, and the cost of not restricting scrubbers should be factored in the decision-making process43.

The overall aim of this study was therefore to investigate several aspects connected to the potential restriction of scrubber water discharge and more specifically (1) to estimate to what extent the global scrubber fleet has reached economic break even on their scrubber installations and the potential monetary gain of using HFO as compared with the more expensive MGO or VLSFO and (2) to assess external costs of not restricting scrubber water discharge by estimating societal damage costs limited to marine ecotoxicity in the Baltic Sea area resulting from nine metals and ten PAHs discharged with scrubber water.

The analyses are based on nine years of real-world simulations of global vessel activity (2014–2022) from the Ship Traffic Emissions Assessment Model (STEAM), version 4.3.0 (ref. 44) and references therein. STEAM combines ship location data from automatic identification systems (AIS), fleet technical description and ship-specific modelling of energy consumption and computes emissions to the atmosphere and direct discharges to the marine environment. The output from STEAM is combined with high-resolution fuel price differences from Ship & Bunker (https://shipandbunker.com/) to calculate the ship-specific annual balance from the time the scrubber was installed until the end of 2022 (exemplified in Extended Data Fig. 1). A selection of the scrubber fleet, operating within the Baltic Sea area, is further assessed with respect to societal damage cost as an example of the cost of not restricting scrubber water discharge. The societal damage cost associated to marine ecotoxicity from scrubber water discharge is estimated by combining results from a previous willingness-to-pay (WTP) study45,46 with the calculated toxicity potentials of nine metals and ten PAHs (from characterization factors collected from the life cycle impact assessment tool ReCiPe47) that are commonly found in open- and closed-loop scrubber water.

Results

A total of 3,818 unique ships are included in the study (Supplementary Fig. 2), of which 3,283 ships (86%) are equipped with open loop, 502 ships (13%) with hybrid and 28 ships (1%) with closed-loop scrubber systems. Most of the scrubber installations (onboard over 2,000 ships) are registered between December 2019 and December 2020. The main ship categories are bulk carriers (36%), container vessels (22%), crude oil and product tankers (26%) and cruise ships (4%) and >90% of the studied scrubber fleet belong to the medium (6,000–15,000 kW installed engine power) and large (>15,000 kW installed engine power) categories.

Economic break-even assessment of the global scrubber fleet

By the end of 2022, the global scrubber fleet that installed scrubbers between 2014 and 2022 has a surplus of €4.7 billion in 2019 euros (€2019), from installing scrubbers and using HFO instead of MGO (in SECA) or VLSFO (outside SECA since 2020) (median balance scenario in Table 1). For the median balance scenario, 51% of the scrubber fleet (1,981 ships) has reached break even with a summarized positive balance of €20197.6 billion by the end of 2022. The ships that have not reached break even by the end of 2022 (1,869 ships, corresponding to 49%) have a summarized negative balance of €20192.9 billion. The total monetary savings from using HFO instead of a more expensive fuel amounts to €201918 billion. The min balance scenario (high costs and low fuel price difference) and the max balance scenario (low costs and high fuel price difference) represent the extremes of realistic favourable (max) and unfavourable (min) conditions from the shipowner perspective.

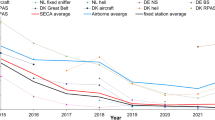

Within five years from the time of installation, more than 95% of the open-loop systems have reached break even, after which the monetary gain from fuel savings will contribute to the surplus (Fig. 2). Thirteen out of the 302 ships that have had their scrubbers installed <1 year (not included in Fig. 2) reach break even within the first year of operation (Supplementary Table 5). The payback time differs between and within the three scrubber systems and can partly be attributed to the year of installation (Supplementary Figs. 4–6) and annual fuel consumption, where higher fuel consumption and higher fuel price difference will result in faster payback times. On the contrary, the longer payback times of hybrid and closed-loop scrubbers can be explained by higher investment and operational costs and, for some vessels, lower annual fuel consumption due to smaller engines. The number of ships (n) included in the stacked bars in Fig. 2 vary depending on the scrubber type and the number of years since installation, for example, very few ships have had their scrubbers installed for nine years or more (Supplementary Table 5 and Supplementary Figs. 4–6).

Distribution of vessels that have (orange, bottom part of bar)/have not (red, top part of bar) reached break even within 1–9 years after the installation of scrubber system. The ships included have had their scrubbers installed >1 year. The three panels show the distribution for ships with open loop (upper panel), hybrid (middle panel) and closed-loop (lower panel) scrubbers. n = the number of ships that are included in the calculation for each year and scrubber type.

Grouping and averaging the annual balance of the vessels that installed their open-loop scrubbers between December 2019 and December 2020 (2020 group, n = 1,835), it can be expected that 50% reach their point of break even 2.5 years after the investment (Fig. 3). The initial balance, that is, the cost of investment, varies between €20192.1 million and 5.1 million, with an average of €20193.1 million, showing good agreement between the 2020 group and the entire open-loop scrubber fleet (Fig. 4b and Supplementary Table 3). The small balance change between the start of 2020 and the start of 2021 can be attributed to the relatively small price difference between HFO and low-sulfur fuels during this period (Fig. 4a–c), where the fuel price, especially for MGO, drops substantially at the beginning of 2020 and remains relatively low until late 2021. During 2022, the fuel prices fluctuate a lot, reaching record-high levels (Fig. 4a) during 2022, explaining the large spread in balance of the 2020 group of the scrubber fleet (from −€20191.8 million to 6.4 million; Fig. 3), where ships with high fuel consumption would increase their balance substantially. In the median balance scenario for the 2020 group, 953 (52%) ships surpassed their break-even point by the end of 2022 and the surplus amounted to almost €20191.5 billion. The positive balance of the fleet that reach break even before the end of 2022 (€20192.2 billion) is almost three times higher than the corresponding negative balance of the 878 ships that did not reach break even (−€20190.8 billion). In the max balance scenario with the 2020 group, all but 47 ships reached break even by the end of 2022 (nearly 50% did so within the first year), and the average surplus amounts to €20199 billion. For the min balance scenario, the higher installation costs (€20194.1 million–9.2 million) and the low fuel price difference results in a slow increase of the balance, and only 89 ships reach break even by the end of 2022.

Selection of fleet that installed open-loop scrubbers in 2020 or December 2019 (ntot = 1,835 ships where 17% were installed in December 2019). The three different scenarios represent max balance (square, dotted-dashed line, red shaded interval), median balance (circle, dashed line, grey shaded interval) and min balance (triangle, dotted line, yellow shaded interval) scenarios. The lines show the average balance of the ships included, and the shaded intervals show the corresponding confidence interval (5th and 95th percentiles). Note the overlap of intervals: as an example, vertical bars on the right show the range of scenarios in 2022.

a, Marine fuel prices (€2019 per tonne fuel) from 2014 until 2023 (left y axis, data from Ship & Bunker) and number of scrubbers installed each year (right y axis). b, Investment cost per kW of open- and closed- (hybrid) loop scrubbers based on total installed engine power as ship size categories (small < 6,000 kW; 6,000 kW < medium < 15,000 kW; large > 15,000 kW). c, Annual fuel price difference of MGO − HFO (black, left) and VLSFO − HFO (yellow, right) from 2014 (2020) to 2022 (based on a). Boxplot shows median (mid line), the box itself represents the 25th–75th percentiles, the whiskers mark the 5th and 95th percentiles and outliers are marked as plus signs.

The cost of not restricting scrubbers in the Baltic Sea

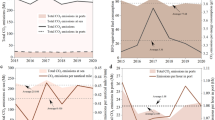

The number of ships equipped with scrubbers in the Baltic Sea area has increased over the years (2014–2022) with a peak of 957 ships in 2020 (Fig. 5a). In 2022, there were 804 unique vessels that operated with scrubbers in the area. The growing scrubber fleet has paradoxically resulted in an increased HFO consumption in this designated SECA, and since 2015, 9.6 million tonnes of HFO have been used and 3.2 billion m3 of open-loop scrubber water plus 0.4 million m3 of closed-loop scrubber water have been discharged within the Baltic Sea area. Most of the contribution (80%) has happened since 2019.

a, Number of vessels with scrubbers installed operating within the Baltic Sea Area 2014–2022. b, Cumulative average damage cost due to environmental deterioration of the marine environment as calculated for marine ecotoxicity based on a WTP study and toxicity potential of open- and closed-loop scrubber water. The error bars indicate the lower and higher estimate of cost where the low (high) WTP estimates are multiplied with the lower (higher) concentration levels of metal (n = 9) and PAH (n = 10) concentrations in scrubber water (Supplementary Table 7).

By combining cost estimates from a WTP study45,46 with toxicity potentials and characterization factors calculated from ReCiPe47, the average societal damage cost, limited to marine ecotoxicity, amounts to 0.21 ± 0.07 €2019 per m3 of open-loop scrubber water discharge. The average cumulative societal damage cost, by not restricting scrubbers in the Baltic Sea Area since the implementation of SECA in 2015, can thus be estimated to €2019680 million (Fig. 5b). The error bars in Fig. 5b represent the range of low and high cumulative cost, where the low (high) range is based on the lower (higher) level of WTP45,46 combined with the low (high) range of the 95% confidence interval of the metal and PAH concentrations in the scrubber water33 (Supplementary Tables 4, 6 and 7). From the private perspective, the shipowners have saved more than €20191.7 billion by not switching to the more expensive but less polluting MGO when operating in the Baltic Sea area.

Discussion

Our assessment, comprising over 3,000 individual ships equipped with scrubbers operating in 2014–2022, shows the strong economic incentives of installing scrubbers. Although the number of ships that have not reached break even constitute almost 50% of the scrubber fleet, the balance calculations show that the positive balance is more than twice as high as the corresponding negative balance, resulting in a scrubber fleet surplus of €20194.7 billion by the end of 2022.

The fuel price difference between MGO and HFO remained relatively stable between 2014 and 2019 although the absolute fuel prices varied over the years (Fig. 4a). Before the SECA implementation in 2015, due to the fear of increased freight rates, the maritime industry anticipated a modal shift from shipping to land-based transport alternatives11. The modal shift was, however, not realized, partly due to the decreasing bunker fuel prices11. Analogously, before the global sulfur cap in 2020, the maritime industry was faced with similar concerns resulting in thousands of scrubbers on order with a backlog of up to five months11, coinciding with the large peak in scrubber installations in 2020 and the unproportionally large drop in MGO price (Fig. 4a), possibly connected to the increasing demand of low-sulfur fuels. In addition, the global impact of the COVID-19 pandemic on the demand was the main driver for the 2020 record low fuel prices11. Since the mid-2020, the fuel prices and the fuel price differences increased, and the huge variability of 2022 could be explained by the current geopolitical landscape, with Russia’s invasion of Ukraine as a major disruptive event. The large fluctuations in fuel price difference will naturally have major effects on the calculations presented in this work, accentuating the strength of using real-world ship-specific simulations together with high-resolution bunker fuel prices.

During 2023, the fuel price difference has fluctuated but remained high as compared with the annual distributions from 2014 to 2022 (Fig. 4a–c). For MGO − HFO, the fuel price difference between January and August 2023 range between US$280 and US$600 per tonne fuel, whereas the VLSFO − HFO fuel price difference is lower and ranges between US$70 and US$240 per tonne fuel (https://shipandbunker.com/). This suggests that for the investigated scrubber fleet, more ships will have reached their point of break even by the end of 2023 and the surplus will be even higher. Assuming that each vessel’s fuel consumption for 2023 is equal to the 2022 fuel consumption and that the fuel price difference is €2019100 per tonne fuel (for VLSFO − HFO) and €2019400 per tonne fuel (for MGO − HFO), an additional 500–1,400 ships in the investigated scrubber fleet would have reached break even by the end of 2023, resulting in a total of 63–86% having reached break even. The assumed fuel price differences in 2023 are lower than in 2022, but the ships that have already installed scrubbers will still reach their point of break even by the end of 2023 due to their relatively small remaining negative balance and the relatively high fuel price difference.

Although the results from the balance calculations might not be absolute for each vessel, this study presents realistic conservative cost estimates of the scrubber fleet on a global level. The three scenarios represent different economic conditions and can capture some of the market variability where the max and min balance scenarios are representing best- and worst-case scenarios from the shipowner perspective. Given the economic incentives of installing scrubbers and the competitiveness of the maritime sector, it is reasonable to assume that the max balance scenario is more likely than the min balance scenario for most ships. If so, the time to reach break even would be shorter than estimated in the median balance scenario, and the 2022 surplus would be higher than €20194.7 billion. Our results show that the majority of the fleet (>51%) already had reached break even by the end of 2022 and are now having an economic advantage due to the lower fuel costs as compared with running their ships on the more expensive low-sulfur fuels.

Due to the lack of integrated global marine status assessments that incorporate economic and social aspects48, the cost of not restricting scrubber water discharge was limited to the Baltic Sea area and includes only the aspect of marine ecotoxicity damage cost based on a WTP study30,45,46. The use of scrubbers, that is, a continued use of HFO, will allow ships to run on fuels with higher metal and PAH content33 than was allowed before the global sulfur cap, resulting in a higher net load of metals and PAHs entering the marine environment34. The discharge of scrubber water has been shown to result in adverse effects in marine organisms13,14,15,16,17 and is in direct conflict with the sustainable development goal 14 and especially target 14.1 stating that we shall ‘…prevent and significantly reduce marine pollution of all kinds…’49. Although the external costs in the Baltic Sea case study only include marine ecotoxicity, limited to a few selected pollutants, the cumulative damage cost from 2015 to 2022 is substantial (≈ €2019700 million).

The estimated societal damage cost of this study is meant to show an added cost due to scrubber water discharge and should not be interpreted as a full damage cost analysis. The estimation of damage cost is based on characterization factors47 and a WTP study46 that presents static values to represent a highly dynamic environment, which should be considered when interpreting the results (Fig. 5b). However, quantifying all the uncertainties is beyond the scope of this study. Nonetheless, ReCiPe47 provides a state-of-the-art life-cycle impact assessment approach that enables a conversion from increased pollution load to ecological toxicity potential and characterization factors that can, with the WTP output45,46, provide an estimated damage cost on marine ecotoxicity. In a previous Baltic Sea case study focusing on external costs for 201830, when the scrubber fleet did not exceed 200 ships (Fig. 5), the damage cost of marine ecotoxicity due to scrubber water discharge constituted approximately 1% of the total damage cost of the impact categories marine ecotoxicity, marine eutrophication, reduced air quality and climate change. Applying the highest annual damage cost due to marine ecotoxicity derived from this study ( = €2019210 million in 2020), keeping all the other damage costs from Ytreberg et al. (2021)30 unchanged, the scrubber water discharge contribution would increase to 6% of the summarized damage cost (€20102.9 billion = €20193.3 billion).

The Baltic Sea case study shows that the cost of not restricting scrubber water discharge can be substantial. The installation of scrubbers has resulted in increased HFO consumption in this fragile sea area, classified as particularly sensitive by IMO50, where it has been determined that pollution loads must be reduced51. Similarly, with the implementation of a Mediterranean SECA in 2025, if low-sulfur options remain much more expensive than HFO, there is a risk that a larger fraction of the scrubber fleet will be operating within the Mediterranean Sea. Learning from the Baltic Sea case study, this could imply higher HFO consumption within the Mediterranean and an overall increased pressure on the marine environment with added societal damage cost. The emerging incentives within IMO and EU25,26 to reduce the greenhouse gas emissions substantially until net zero by 2050 will presumably limit the use of fossil fuels in the medium- and long-term timeframe, but as shown in this study, the short payback times of scrubbers can make them lucrative in the short-term transition time before the stricter regulations and limitations are implemented. This will also entail a risk of increased HFO usage in areas where it is possible and, more importantly, economically profitable.

Scrubbers do enable a continued use of fossil fuels, hampering the transition to a sustainable transport system. In addition, the water needed for the scrubbing process requires more energy for pumps and so on, resulting in higher fuel consumption, that is, higher CO2 emissions, per travelled distance52,53. A previous study also suggested that shipowners are economically encouraged to increase the operating speed on a ship with a scrubber as compared to one without54. The increased speed will further raise the CO2 emissions due to the cubic dependence of speed and engine power. Higher CO2 emissions are both in conflict with sustainable development goal 13 (ref. 49) and directly oppose the ambitions and commitments set by IMO25 and the European Union26. Another aspect of scrubber water discharge includes strong acid addition to the sea18,19. Although the full effects on acidification remain unresolved18,19,29, model results show that scrubber water discharge can have notable effects in areas of high shipping intensity, reducing the seawater buffer capacity, that is, reducing the uptake of CO2 and affecting marine life18,19.

To conclude, our results show a strong economic incentive to install scrubbers, which in combination with an increasing number of scientific studies demonstrating adverse effects on marine organisms13,14,15,16,17, contradicts the argument that shipowners have been acting in good faith and risk being penalized if stricter regulations on scrubbers are implemented42,55.

Methods

To assess the use of scrubbers, two different perspectives were analysed with respect to costs and environmental damage:

-

The investor, that is, the shipowner, perspective: calculating the break-even time of ship-specific scrubber installations of the global scrubber fleet based on installation cost, annual operational costs and monetary gain by using HFO instead of MGO (inside SECA) or VLSFO (outside of SECA).

-

The socio-economical perspective: as a Baltic Sea area case study, assessing the cost of not restricting scrubber water discharge by estimating the damage costs due to marine ecotoxicity of nine metals and ten PAHs from scrubber water discharge.

For comparison, all costs (€) have been indexed to 2019 (€2019) according to the Organisation for Economic Co-operation and Development (OECD) complete database of consumer price indices for comparison (https://stats.oecd.org/). MATLAB (R2020a) was used for all calculations and plotting of data56.

Economic break-even calculations of the scrubber fleet

The Ship Traffic Emissions Assessment Model STEAM (ref. 44 and references therein), version 4.3.0, was used to estimate ship-specific annual energy and main engine load, fuel consumption, amount of discharged scrubber water, amount of energy consumed for scrubber use and kilometres travelled in different sea areas. The data were provided for each individual ship using Automatic Identification System (AIS), mandatory for ships >300 GT (ref. 57), between 2014 and 2022. These data were provided by Orbcomm Ltd. and included position reports from both terrestrial and satellite AIS networks. Technical description of the global fleet, which enables STEAM modelling at the vessel level, were obtained from SP Global. From all data, those ships that had registered a certificate of approval of scrubber installation within the timeframe (2014–2022) were selected for further analysis (maximum of 3,922 ships in 2022). STEAM identifies ships based on IMO numbers, registry numbers that remain with the vessel from construction to scrapping, and MMSI codes, which is the Maritime Mobile Service Identity number of the ship’s radio system, but the output data were anonymized by creating an artificial but unique identification number for each ship.

Annual balance was calculated for each unique ship by accounting for investment cost as starting conditions and annual operational costs and monetary savings on fuels from the use of HFO instead of MGO or VLSFO. Each ship was modelled from the date of installation until the end of 2022 (see example of ship with open-loop scrubber in Extended Data Fig. 1). The date of installation was given as year and month in STEAM, based on the ship-specific class certificate letter stating the date of approval to operate the scrubber.

The investment cost per kilowatt (€2019 kW−1; Fig. 4b) for scrubber systems was collected from literature (for example, refs. 52,58,59,60,61,62,63, and detailed description in Supplementary Table 1) where the median (50th), 5th and 95th percentiles were used in the different scenarios (Table 1 and Supplementary Table 1). Due to limited data availability, the hybrid systems were assigned the same investment cost as closed-loop systems (Fig. 4b). Due to the variability in price connected to installed engine power, the ships and the cost were divided into three size categories based on total installed main engine power (Fig. 4b). The total installed main engine power of the specific ships in the scrubber fleet were determined from SP Global ship database where power-regression equations based on a selection of 110,000 ships (65,000 excluding fishing vessels, tugs and service vessels) in different ship categories were used to calculate the engine power from the ship category and gross tonnage (derivations found in Supplementary Information C). Due to poor data fit, statistical data binning was used instead of power regression for container ships and roll on–roll off (RoRo) vessels. The total investment cost per ship is summarized in Supplementary Fig. 1 and Supplementary Table 3.

The operational costs were estimated from literature (for example, refs. 8,52,64,65,66, and detailed description in Supplementary Table 1) and calculated for each ship based on annual main engine power output associated to the scrubber use. For the hybrid systems, the fraction of power used in open- (fracOL) versus closed- (fracCL = 1 − fracOL) loop mode was calculated from the annual discharges of open- and closed-loop water according to equation (1).

where QOL/CL is the discharge flow rate of open- (90 m3 MWh−1) and closed- (0.45 m3 MWh−1) loop systems30 and VOL/CL are the annual volumes (m3) of open- and closed-loop water discharged from the specific ships. The annual operational cost of the different scrubber systems was then calculated from the annual engine power usage (MW yr−1) during the time when the scrubber was operated (Pscrubber on) and the power-based operational costs (€2019 MW−1) for open- and closed-loop scrubbers (costoperation OL/CL) (equation (2)).

For the open-loop scrubbers, fracOL = 1 and for the closed-loop scrubbers, fracCL = 1.

The daily resolution of fuel price (between 2014 and 2022) of HFO, MGO and VLSFO (starting 2019) was received from Ship & Bunker (Fig. 4a). The Global 20 Ports Average bunker prices were used, which cover the 20 major global bunker ports and represent approximately 60–65% of the absolute global bunker volumes. In the different scenarios (Table 1), the annual median (50th) and the 5th and 95th percentiles of the fuel price difference between HFO/MGO and HFO/VLSFO were used when calculating annual balance (Fig. 4a–c). VLSFO was introduced to the market in late 2019, and from 2020, it was assumed that the alternative fuel to HFO and scrubbers are MGO in SECA and VLSFO outside SECA (equation (3)). Before the introduction of VLSFO, it is assumed that distillates were the only alternative to the use of scrubbers, and the fuel price difference between MGO and HFO is applied. The annual monetary gain (Δcostfuel,yr in €2019 yr−1) attributed to the use of HFO instead of low-sulfur fuels are calculated from the fuel consumption (cons.HFO,yr in tonnes fuel yr−1) and fuel price difference (Δprice in €2019 per tonnes fuel) for the individual years (equation (3)).

Where DnonSECA/SECA,yr represents the distance travelled in SECA/non-SECA areas and Dtot,yr is the total annual distance sailed according to STEAM data output for each vessel and year (Supplementary Table 2). Fuel penalties of 2–3% from scrubber operations are the most common estimates52,53, and an additional factor of 0.94 (VLSFO) and 0.92 (MGO) is applied due to the fuel penalty of using a scrubber (2%) and the higher energy content, that is, lower fuel consumption, of the low-sulfur fuels67.

The annual balance for each ship was calculated by summarizing the costs (negative signs) and the monetary gain from using HFO instead of low-sulfur fuels (positive sign) (equations (4) and (5)). For the first year, that is same year as installation, the balance was calculated from the investment cost (costinv.), the cost of operation (costoperation,yr) and the fuel cost savings (that is monetary gain from using HFO instead of low-sulfur fuels (Δcostfuel,yr)) where the two latter were adjusted to the number of months when the scrubber had been in service (equation (4)). For the remaining years, until the end of 2022, the annual balance was calculated by summarizing the balance from the previous year with the operational cost and the monetary gain on fuel by not switching to low-sulfur fuels from the current year (equation (5)).

To assess the variability of market fluctuations, the balance was estimated from three different calculation scenarios:

-

Median balance scenario: using the median for all costs, that is, fuel price difference, investment cost and operational cost;

-

Min balance scenario: using the 5th percentile in fuel price difference and the 95th percentile of investment and operational cost;

-

Max balance scenario: using the 95th percentile in fuel price difference and the 5th percentile of investment and operational cost.

The net surplus of the global fleet was calculated by summarizing the balance for every vessel at the end of 2022 (equation (6)).

The calculations for the individual ships were further assessed to estimate payback times for the fleet (Fig. 2) and selecting a group of the open-loop fleet that had their scrubbers installed between December 2019 and December 2020 (n = 1,835) to illustrate the variation within the fleet and the outcome of applying the different calculation scenarios.

Cost of not restricting as damage on the marine environment

To assess the societal cost of not restricting scrubber water discharge, the dataset was limited to a Baltic Sea case study. The selection of ships was based on their operating area, that is, distance sailed in the Baltic Sea, the Gulf of Bothnia, Gulf of Finland, Gulf of Riga, Kattegat and Skagerrak (Supplementary Table 2) since the time of their scrubber installation. The HFO consumption and the volumes of scrubber water discharged within the Baltic Sea area for each ship was estimated from the total annual HFO consumption and the fraction sailed within Baltic Sea, calculated from the distance sailed in the Baltic Sea area divided by the total distance sailed for the given year.

The damage cost calculations were limited to marine ecotoxicity from the discharge of scrubber water, that is, based on the concentration of nine metals and ten PAHs in the scrubber water33. First, the cumulative toxicity potential of open- and closed-loop scrubber water was calculated using characterization factors from ReCiPe47 (Supplementary Table 4). ReCiPe offers a harmonized indicator approach where characterization factors for organic substances and metals for different environmental compartments, including marine waters, have been produced47. With ReCiPe, each metal and PAH were assigned a characterization factor based on their fate and effect factor in relation to 1,4-dichlorobenzene (as 1,4 DCB equivalents (eq)). The cumulative toxicity potentials of open- and closed-loop scrubber water (kg 1,4 DCB eq. m−3) were obtained by summarizing the products of the metal and PAH characterization factor (as 1,4 DCB eq) and their corresponding concentrations in scrubber water (µg l−1) (Supplementary Table 4).

Second, the cumulative toxicity potential had to be related to a cost. Previous work have valuated the ecotoxicological impacts from the organotin compound tributyltin (TBT) in Sweden by conducting an extensive WTP study of Swedish households, where the damage cost (€2019 kg−1 1,4 DCB eq) amounted to €20191.07 kg−1 1,4 DCB eq (€20190.73–1.29 kg−1 1,4 DCB eq) (refs. 45,46).

Finally, the annual damage cost for marine ecotoxicity (€2019 yr−1) resulting from scrubber discharge water (that is, the nine metals and ten PAHs commonly detected in scrubber water) in the Baltic Sea area (including Skagerrak) was calculated by multiplying the total volume scrubber water discharged in the area (m3 yr−1) with the marine toxicity of open- and closed-loop scrubber water (as kg 1,4 DCB eq. m−3) and the damage cost of marine ecotoxicity (€2019 kg−1 1,4 DCB eq). A lower (higher) estimate was calculated by applying the lower (higher) concentrations of metals and PAHs, that is, lower (higher) toxicity potential of scrubber water and the lower (higher) WTP estimates (Supplementary Tables 6 and 7).

Reporting summary

Further information on research design is available in the Nature Portfolio Reporting Summary linked to this article.

Data availability

Data are provided within the paper and the Supplementary Information. Bunker fuel prices are commercially available with Ship & Bunker (admin@shipandbunker.com). The ship activity datasets (STEAM) were obtained from J.-P. Jalkanen (Jukka-Pekka.Jalkanen@fmi.fi). The AIS data and technical description of the world fleet used as input to STEAM are governed by contracts with third parties and cannot be shared. Ship size and installed power (Supplementary Information C) was collected from Sea-web’s database of ships in the global fleet (S&P Global, previously IHS Markit Maritime & Trade: www.maritime.ihs.com/). The national assessments of environmental status according to the Marine Strategy Framework Directive (MSFD) were collected from the European Environment Agency Water Information System for Europe database https://water.europa.eu/marine/data-maps-and-tools/msfd-reporting-information-products/ges-assessment-dashboards/country-thematic-dashboards. In QGIS (version 3.16.11 Hannover), the open-access data layer ‘ESRI Ocean’ was used to visualize the regions in Fig. 1. Characterization factors were collected from ReCiPe (v.1.1) available at https://www.rivm.nl/en/life-cycle-assessment-lca/downloads. The OECD complete database of consumer price indices was downloaded from https://stats.oecd.org/#.

Code availability

STEAM and its source code are property of the Finnish Meteorological Institute and are not available (controlled access). The custom MATLAB scripts for calculations and plotting of figures are available via Zenodo at https://doi.org/10.5281/zenodo.10944805 (ref. 56).

References

Uhler, A. D., Stout, S. A., Douglas, G. S., Healey, E. M. & Emsbo-Mattingly, S. D. in Standard Handbook Oil Spill Environmental Forensics 2nd edn (eds Stout, S. A. & Wang, Z.) 641–683 (Academic Press, 2016).

IMO. MARPOL Annex VI - Prevention of Air Pollution from Ships. Issued by the International Maritime Organization (IMO, 2020).

Sofiev, M. et al. Cleaner fuels for ships provide public health benefits with climate tradeoffs. Nat. Commun. 9, 406 (2018).

Zetterdahl, M., Moldanová, J., Pei, X., Pathak, R. K. & Demirdjian, B. Impact of the 0.1% fuel sulfur content limit in SECA on particle and gaseous emissions from marine vessels. Atmos. Environ. 145, 338–345 (2016).

Claremar, B., Haglund, K. & Rutgersson, A. Ship emissions and the use of current air cleaning technology: contributions to air pollution and acidification in the Baltic Sea. Earth Syst. Dynam. 8, 901–919 (2017).

Van Roy, W. et al. International maritime regulation decreases sulfur dioxide but increases nitrogen oxide emissions in the North and Baltic Sea. Commun. Earth Environ. 4, 391 (2023).

Andreasen, A. & Mayer, S. Use of seawater scrubbing for SO2 removal from marine engine exhaust gas. Energy Fuels 21, 3274–3279 (2007).

den Boer, E. & ’t Hoen, M. Scrubbers–An Economic and Ecological Assessment. For NABU. Publication Code: 15.4F41.20 (NABU, 2015).

Jiang, L., Kronbak, J. & Christensen, L. P. The costs and benefits of sulfur reduction measures: sulphur scrubbers versus marine gas oil. Transp. Res. Part D Transp. Environ. 28, 19–27 (2014).

Zou, J. & Yang, B. Evaluation of alternative marine fuels from dual perspectives considering multiple vessel sizes. Transp. Res. Part D: Transp. Environ. 115, 103583 (2023).

Zis, T. P. V., Cullinane, K. & Ricci, S. Economic and environmental impacts of scrubbers investments in shipping: a multi-sectoral analysis. Marit. Policy Manage. 49, 1097–1115 (2022).

Zhu, M., Li, K. X., Lin, K.-C., Shi, W. & Yang, J. How can shipowners comply with the 2020 global sulfur limit economically? Transp. Res. Part D: Transp. Environ. 79, 102234 (2020).

Koski, M., Stedmon, C. & Trapp, S. Ecological effects of scrubber water discharge on coastal plankton: potential synergistic effects of contaminants reduce survival and feeding of the copepod Acartia tonsa. Mar. Environ. Res. 129, 374–385 (2017).

Thor, P., Granberg, M. E., Winnes, H. & Magnusson, K. Severe toxic effects on pelagic copepods from maritime exhaust gas scrubber effluents. Environ. Sci. Technol. 55, 5826–5835 (2021).

Ytreberg, E. et al. Effects of scrubber washwater discharge on microplankton in the Baltic Sea. Mar. Pollut. Bull. 145, 316–324 (2019).

Picone, M. et al. Impacts of exhaust gas cleaning systems (EGCS) discharge waters on planktonic biological indicators. Mar. Pollut. Bull. 190, 114846 (2023).

Ytreberg, E. et al. Effects of seawater scrubbing on a microplanktonic community during a summer-bloom in the Baltic Sea. Environ. Pollut. 291, 118251 (2021).

Dulière, V., Baetens, K. & Lacroix, G. Potential Impact of Wash Water Effluents from Scrubbers on Water Acidification in the Southern North Sea (RBINS, 2020).

Hassellöv, I.-M., Turner, D. R., Lauer, A. & Corbett, J. J. Shipping contributes to ocean acidification. Geophys. Res. Lett. 40, 2731–2736 (2013).

Ülpre, H. & Eames, I. Environmental policy constraints for acidic exhaust gas scrubber discharges from ships. Mar. Pollut. Bull. 88, 292–301 (2014).

Marin-Enriquez, O. et al. Environmental Impacts of Discharge Water from Exhaust Gas Cleaning Systems on Ships Final report of the project ImpEx (German Environment Agency, 2023).

Fridell, E. & Salo, K. Measurements of abatement of particles and exhaust gases in a marine gas scrubber. Proc. Inst. Mech. Eng., Part M: J. Eng. Marit. Environ. 230, 154–162 (2016).

Lindstad, H. E. & Eskeland, G. S. Environmental regulations in shipping: policies leaning towards globalization of scrubbers deserve scrutiny. Transp. Res. Part D: Transp. Environ. 47, 67–76 (2016).

Oil 2021. Analysis and forecast to 2026 (IEA, 2021).

Resolution MEPC.377(80). Adopted on 7 July 2023. 2023 IMO Strategy on Reduction of GHG Emissions from Ships (IMO, 2023).

COM/2021/550 Final Communication from the Commision to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions ‘Fit for 55’: Delivering the EU’s 2030 Climate Target on the Way to Climate Neutrality (EC, 2021).

Endres, S. et al. A new perspective at the ship–air–sea-interface: the environmental impacts of exhaust gas scrubber discharge. Front. Mar. Sci. https://doi.org/10.3389/fmars.2018.00139 (2018).

Teuchies, J., Cox, T. J. S., Van Itterbeeck, K., Meysman, F. J. R. & Blust, R. The impact of scrubber discharge on the water quality in estuaries and ports. Environ. Sci. Eur. 32, 103 (2020).

Turner, D. R., Hassellöv, I.-M., Ytreberg, E. & Rutgersson, A. Shipping and the environment: smokestack emissions, scrubbers and unregulated oceanic consequences. Elem. Sci. Anth. https://doi.org/10.1525/elementa.167 (2017).

Ytreberg, E., Åström, S. & Fridell, E. Valuating environmental impacts from ship emissions—the marine perspective. J. Environ. Manage. 282, 111958 (2021).

Schmolke, S. et al. Environmental Protection in Maritime Traffic–Scrubber Wash Water Survey (German Environment Agency, 2020); https://www.umweltbundesamt.de/en/publikationen/environmental-protection-in-maritime-traffic

Osipova, L., Georgeff, E. & Comer, B. Global Scrubber Washwater Discharges Under IMO’s 2020 Fuel Sulfur Limit (ICCT, 2021).

Lunde Hermansson, A., Hassellöv, I.-M., Moldanová, J. & Ytreberg, E. Comparing emissions of polyaromatic hydrocarbons and metals from marine fuels and scrubbers. Transp. Res. Part D: Transp. Environ. 97, 102912 (2021).

Ytreberg, E. et al. Metal and PAH loads from ships and boats, relative other sources, in the Baltic Sea. Mar. Pollut. Bull. 182, 113904 (2022).

Lunde Hermansson, A., Hassellöv, I.-M., Jalkanen, J.-P. & Ytreberg, E. Cumulative environmental risk assessment of metals and polycyclic aromatic hydrocarbons from ship activities in ports. Mar. Pollut. Bull. 189, 114805 (2023).

2022 Guidelines for Risk and Impact Assessments of the Discharge Water from Exhaust Gas Cleaning Systems MEPC.1/Circ.899 (MEPC, 2022).

Directive 2008/56/EC of the European Parliament and of the Council of 17 June 2008 Establishing a Framework for Community Action in the Field of Marine Environmental Policy (Marine Strategy Framework Directive) (EC, 2008).

Sardain, A., Sardain, E. & Leung, B. Global forecasts of shipping traffic and biological invasions to 2050. Nat. Sustain. 2, 274–282 (2019).

Halpern, B. S. et al. Recent pace of change in human impact on the world’s ocean. Sci. Rep. 9, 11609 (2019).

Carraro, C. Policy Update: Global Update on Scrubber Bans and Restrictions (ICCT, 2023); https://theicct.org/publication/marine-scrubber-bans-and-restrictions-jun23/

MEPC Agenda Item MEPC 79/5/3. Air Pollution Prevention–EGCS and UNCLOS. Submitted by FOEI, Greenpeace International, WWF, Pacific Environment, CSC and Inuit Circumpolar Council (IMO, 2022).

MEPC MEPC 79/15 Agenda Item 15–Report of the Marine Environment Protection Committee on its Seventy-ninth Session. Section 5 Air Pollution Prevention–Matters Relating to Exhaust Gas Cleaning Systems. Paragraph 5.9 (IMO, 2022).

MEPC MEPC 80/5/5 Agenda Item 5–Air Pollution Prevention–Proposal to Further Develop Part 3 (Regulatory Matters) on the Scope of Work for the Evaluation and Harmonisation of Rules and Guidance on the Discharges and Residues from EGCSs into the Aquatic Environment, Including Conditions and Areas. Submitted by Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands (Kingdom of the), Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the European Commission (IMO, 2023).

Jalkanen, J. P. et al. Modelling of discharges from Baltic Sea shipping. Ocean Sci. 17, 699–728 (2021).

Noring, M. Valuing Ecosystem Services–Linking Ecology and Policy. PhD thesis, KTH–Royal Institute of Technology (2014).

Noring, M., Håkansson, C. & Dahlgren, E. Valuation of ecotoxicological impacts from tributyltin based on a quantitative environmental assessment framework. Ambio 45, 120–129 (2016).

Huijbregts, M. A. J. et al. ReCiPe2016: a harmonised life cycle impact assessment method at midpoint and endpoint level. Int. J. Life Cycle Assess. 22, 138–147 (2017).

The Second World Ocean Assessment Vol. II (UN, 2021).

A/RES/70/1. Transforming Our World: the 2030 Agenda for Sustainable Development. Resolution Adopted by the General Assembly on 25 September 2015 (UN, 2015).

MEPC Resolution MEPC.136(53)–Designation of the Baltic Sea Area as a Particularly Sensitive Sea Area (Adopted on 22 July 2005) (MEPC, 2005).

HELCOM Baltic Sea Action Plan 2021 Update. Baltic Marine Environment Protection Commission (HELCOM, 2021); https://helcom.fi/wp-content/uploads/2021/10/Baltic-Sea-Action-Plan-2021-update.pdf

Yaramenka, K., Melin, A., Malmeaus, M. & Winnes, H. Scrubbers: Closing the Loop Activity 3: Task 3 Cost Benefit Analysis IVL report B2320 (IVL Swedish Environmental Research Institute, 2018).

Brynolf, S., Magnusson, M., Fridell, E. & Andersson, K. Compliance possibilities for the future ECA regulations through the use of abatement technologies or change of fuels. Transp. Res. Part D: Transp. Environ. 28, 6–18 (2014).

Lindstad, H. E., Rehn, C. F. & Eskeland, G. S. Sulphur abatement globally in maritime shipping. Transp. Res. Part D: Transp. Environ. 57, 303–313 (2017).

PPR 11/7/1 Evaluation and Harmonization of Rules and Guidance on the Discharge of Discharge Water from EGCS into the Aquatic Environment, Including Conditions at Sea. Comments on Proposals to Prohibit the Use of EGCS and Their Discharges. Submitted by ICS (IMO, 2024).

Hermansson, A. L. Supplementary MATLAB script for ‘Strong economic incentives of ship scrubbers promoting pollution’. Zenodo https://doi.org/10.5281/zenodo.10944805 (2024).

SOLAS Chapter V Regulation 19–Carriage Requirements for Shipborne Navigational Systems and Equipment (SOLAS, 2020).

Andersson, K., Jeong, B. & Jang, H. Life cycle and cost assessment of a marine scrubber installation. J. Int. Marit. Saf. Environ. Aff. Ship. 4, 162–176 (2020).

Gu, Y. & Wallace, S. W. Scrubber: a potentially overestimated compliance method for the emission control areas: the importance of involving a ship’s sailing pattern in the evaluation. Transp. Res. Part D: Transp. Environ. 55, 51–66 (2017).

Karatuğ, Ç., Arslanoğlu, Y. & Guedes Soares, C. Feasibility analysis of the effects of scrubber installation on ships. J. Mar. Sci. Eng. 10, 1838 (2022).

Lindstad, H., Sandaas, I. & Strømman, A. H. Assessment of cost as a function of abatement options in maritime emission control areas. Transp. Res. Part D: Transp. Environ. 38, 41–48 (2015).

Panasiuk, I. & Turkina, L. The evaluation of investments efficiency of SOx scrubber installation. Transp. Res. Part D: Transp. Environ. 40, 87–96 (2015).

Wijayanto, D. & Suasti Antara, G. B. D. Comparison analysis of options to comply with IMO 2020 sulphur cap regarding environmental and economic aspect. IOP Conf. Ser.: Earth Environ. Sci. 1081, 012051 (2022).

Bachér, H. & Albrecht, P. Evaluating the Costs Arising from New Maritime Environmental Regulations (Transport Safety Agency (Trafi), 2013).

Kjølholt, J., Aakre, S., Jürgensen, C. & Lauridsen, J. Assessment of Possible Impacts of Scrubber Water Discharges on the Marine Environment (DMA, 2012).

Papadimitriou, G., Markaki, V., Gouliarou, E., Borken-Kleefeld, J. & Ntziachristos, L. Best Available Techniques for Mobile Sources in support of a Guidance Document to the Gothenburg Protocol of the LRTAP Convention Technical Report (DG Environment, 2015).

Pavlenko, N., Comer, B., Zhou, Y., Clark, N. N. & Rutherford, D. The Climate Implications of Using LNG as a Marine Fuel (ICCT, 2020).

Acknowledgements

The project has received funding from the Swedish Agency for Marine and Water management (grant agreement number 2911-22) (A.L.H., E.Y., I.-M.H., J.H.), the Swedish Transport Administration (grant agreement TRV 2021/12071) (A.L.H., E.Y., I.-M.H., R.P., E.F.) and by the European Union’s Horizon 2020 research and innovation programme Evaluation, control and Mitigation of the EnviRonmental impacts of shippinG Emissions (EMERGE) (grant agreement number 874990) (A.L.H., E.Y., I.-M.H., J.-P.J., T.G., R.P., E.F.).This work reflects only the authors’ view, and CINEA is not responsible for any use that may be made of the information it contains. We thank M. Lasek at Ship & Bunker for generously providing us with high-resolution fuel price data and J. Näsström at Chalmers University of Technology for her contribution in compiling the environmental status assessment. We would also like to express our gratitude to D. Turner at the University of Gothenburg for proofreading and providing valuable input.

Funding

Open access funding provided by Chalmers University of Technology.

Author information

Authors and Affiliations

Contributions

A.L.H.: methodology, investigation, writing–original draft, writing–review and editing, visualization, formal analysis. I.-M.H.: conceptualization, writing–review and editing, supervision, funding acquisition. T.G.: writing–review and editing, data curation, resources. J.-P.J.: writing–review and editing, resources, funding acquisition. E.F.: writing–review and editing, resources, funding acquisition. R.P.: writing–review and editing, resources, data curation. J.H.: writing–review and editing, data curation. E.Y.: conceptualization, investigation, writing–review and editing, supervision, funding acquisition.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Sustainability thanks Yasin Arslanoglu, Xiaowen Fu, Jeroen Pruijn and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Extended data

Extended Data Fig. 1 Example of balance calculation of a ship with an open loop system installed in September 2015.

The upper level of the balance range corresponds to calculation with the Max Balance scenario and the lower range correspond to the Min Balance scenario. The full line represents the outcome of the Median Balance scenario. At the Date of Installation, the balance equals the investment cost (costinv) and the balance at the end of each year is calculated according to Eqs. (4) and (5). The payback time is defined as the time between date of installation and the point of break-even, that is the time when Balance=0.

Supplementary information

Supplementary Information

Supplementary Information A: description of assessment of marine environmental status (Supplementary Fig 1); B: complementary information to manuscript (Supplementary Tables 1–7 and Figs. 2–8); C: relationship between engine power and gross tonnage of ships (Supplementary Table 8 and Figs. 9–23).

Supplementary Code 1

MATLAB file with the script used for calculations of global fleet.

Supplementary Code 2

MATLAB file with the script used for calculations of Baltic Sea case study.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Lunde Hermansson, A., Hassellöv, IM., Grönholm, T. et al. Strong economic incentives of ship scrubbers promoting pollution. Nat Sustain (2024). https://doi.org/10.1038/s41893-024-01347-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41893-024-01347-1